Cyprus: The Ultimate Tax Haven for Nomads, Entrepreneurs, and Retirees

Why Cyprus is the Perfect Destination for Tax Optimization and Lifestyle in 2025Cyprus, the Mediterranean island known for its pristine beaches, rich history, and vibrant culture, is also a global leader in tax optimization. With its attractive tax regime, Cyprus has become a top destination for expats, entrepreneurs, digital nomads, and retirees seeking to minimize their tax liabilities while enjoying a high quality of life.

In light of recent changes to the UK’s non-dom regime, Cyprus is emerging as an even more compelling alternative for those looking to relocate their tax residency. In this article we will dive into the details of Cyprus’s tax advantages and why it’s becoming the go-to destination for savvy taxpayers.

Cyprus Tax Residency: The 60-Day Rule

Cyprus offers one of the most flexible tax residency requirements in the EU. To qualify as a tax resident, you only need to meet the 60-day rule:

Spend at least 60 days in Cyprus during the tax year.

Do not spend more than 183 days in any other single country.

Not to be considered tax resident by any other state.

Maintain Cyprus ties, such as a permanent residence (owned or rented) and engage in business, employment, or hold a directorship in a Cyprus tax-resident company.

This makes Cyprus an ideal destination for digital nomads, remote workers, and globetrotters who want to maintain tax efficiency without being tied to one location.

The Cyprus Non-Dom Program: A Taxpayer’s Dream

Introduced in 2015, the Cyprus non-dom program is designed to attract foreign individuals and businesses by offering some of the most favorable tax treatments in Europe. Here’s what makes Cyprus tax residency so appealing:

1. Tax Exemptions on Dividends and Interest

Non-domiciled tax residents in Cyprus enjoy a 17-year exemption from the Special Defence Contribution (SDC) tax, which typically applies to dividends and interest. This means:

Dividends: Whether from local or foreign investments, dividends are completely tax-free for non-doms.

Interest: Income from savings accounts, bonds, or other interest-bearing instruments is also tax-free.

2. No Capital Gains Tax (Except on Real Estate)

Cyprus imposes no capital gains tax on the sale of shares, ETFs, or other securities, as long as the underlying assets do not include Cypriot real estate. This makes it an ideal location for investors with significant stock portfolios.

3. No Wealth or Inheritance Taxes

Unlike many other countries, Cyprus has no wealth tax and no inheritance tax for gifts between close family members. This is a major draw for HNWIs looking to preserve their wealth across generations.

4. Low Corporate Tax Rate

Cyprus boasts one of the lowest corporate tax rates in the EU at 12.5%.

Who Qualifies as a Non-Dom?

To qualify for Cyprus non-dom status, you must:

Not have been a tax resident in Cyprus for 17 out of the last 20 years.

Spend at least 60 days per year in Cyprus.

Maintain ties to Cyprus, such as a rental contract or property ownership.

Personal Income Tax in Cyprus

Cyprus taxes its residents on worldwide income, but the rates are highly competitive, especially when combined with various exemptions and incentives.

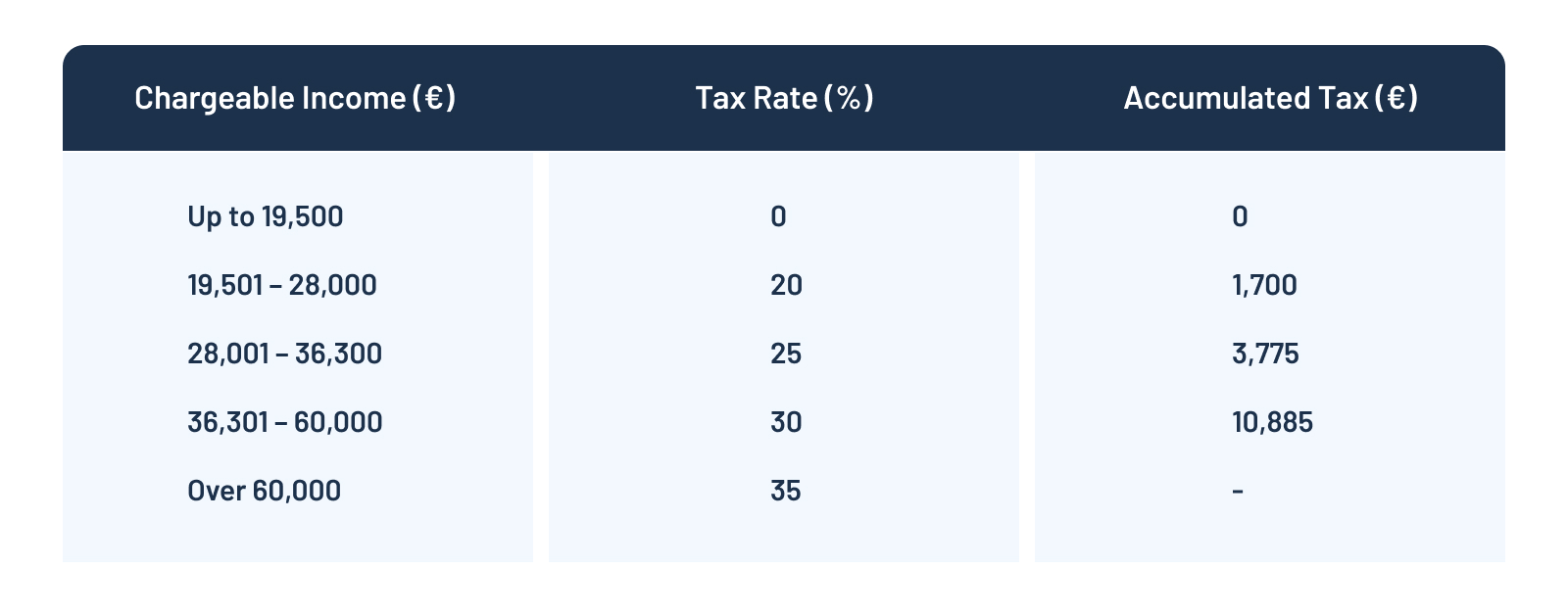

The following progressive tax rates apply to individuals:

Key Exemptions and Deductions

Foreign Pension Income: Taxed at a flat rate of 5% on amounts exceeding €3,420. Alternatively, taxpayers can opt to be taxed at the normal rates.

First Employment Exemption: For individuals who were not tax residents in Cyprus for 15 consecutive years prior to employment, 50% of their salary is exempt from tax for 17 years.

Skilled Workers: A 20% tax exemption on salaries up to €8,550 annually for individuals who were not tax residents in Cyprus for 3 consecutive years prior to employment.

Corporate Tax: A Business-Friendly Regime

Cyprus offers one of the lowest corporate tax rates in the EU at 12.5%. Combined with various exemptions and incentives, it’s a prime location for businesses.

Intellectual Property (IP) Box Regime: An 80% exemption on profits from qualifying IP assets, resulting in an effective tax rate as low as 2.5%.

Other Taxes for Companies

Gesy Contributions: Employers and employees contribute to the General Healthcare System (Gesy). The employer’s contribution is 2.65% of the employee’s salary, while the employee contributes 2.65% (capped at €180,000 annually).

Special Defence Contribution (SDC): Applies to dividends, interest, and rental income for Cypriot tax residents, but non-doms are exempt for 17 years.

VAT in Cyprus

Cyprus imposes VAT on the supply of goods and services, with the following rates:

Standard Rate: 19%

Reduced Rates: 9%, 5%, and 3% (applicable to specific goods and services, such as food, pharmaceuticals, and hotel accommodations).

Zero Rate: Applicable to exports and certain international services.

VAT on Services Rendered Outside Cyprus

Services rendered to clients outside Cyprus are not subject to VAT, provided the client is not based in Cyprus. This makes Cyprus an attractive location for digital nomads and remote workers who provide services to international clients.

Lifestyle Benefits

Climate: Over 300 days of sunshine per year.

Healthcare: Access to high-quality healthcare through the General Healthcare System (Gesy), with contributions capped at 2.65% of income (up to €180,000 annually).

Cost of Living: More affordable compared to other EU countries.

Rich History and Culture: Cyprus is a treasure trove of history and culture, with influences from Greek, Roman, Byzantine, and Ottoman civilizations.

Delicious Cuisine: Cypriot cuisine is a delightful blend of Greek, Turkish, and Middle Eastern flavors.

Family-Friendly Environment: Cyprus is an excellent place to raise a family, offering international schools, safe communities and outdoor activities.

Cyprus vs. the UK: A Competitive Edge

With the UK’s non-dom regime set to be phased out by April 2025, Cyprus is becoming an even more attractive alternative. Key advantages include:

A 17-year tax exemption for non-doms, compared to the UK’s 4-year window.

No remittance-based taxation, meaning income brought into Cyprus is not taxed.

A simpler and more stable tax system, without the complexities of the UK’s remittance basis.

Cyprus is the Future of Tax Optimization

Cyprus offers a unique combination of tax efficiency, lifestyle benefits, and EU integration, making it a top choice for expats, entrepreneurs, and retirees. With its flexible residency requirements, low corporate tax rate, and generous exemptions, Cyprus is well-positioned to attract even more global talent and investment in the coming years.

Whether you’re a digital nomad, a business owner, or a retiree, Cyprus provides the perfect environment to optimize your taxes while enjoying the Mediterranean lifestyle.

Permanent Residency Through Real Estate Investment

One of the easiest ways to become a tax resident in Cyprus is through the Permanent Residency (PR) by Investment program. This program allows non-EU nationals to obtain PR by investing in real estate.

Key Requirements of Cyprus PR through residential real estate

Minimum Investment: €300,000 (excluding VAT) in residential property.

Financial Criteria: Proof of a secured annual income of at least €50,000 (increased by €15,000 for a spouse and €10,000 per dependent child).

Residency Requirements: Visit Cyprus at least once every two years to maintain PR status.

WHATSAPP

WHATSAPP

PHONE

PHONE

TELEGRAM

TELEGRAM